Property Tax Rate Los Angeles County Ca . click below to download the tax rate area lookup file in.csv format (available for current year only). the median property tax in los angeles county, california is $2,989 per year for a home worth the median value of $508,800. the median property tax (also known as real estate tax) in los angeles county is $2,989.00 per year, based on a median.

from lao.ca.gov

click below to download the tax rate area lookup file in.csv format (available for current year only). the median property tax (also known as real estate tax) in los angeles county is $2,989.00 per year, based on a median. the median property tax in los angeles county, california is $2,989 per year for a home worth the median value of $508,800.

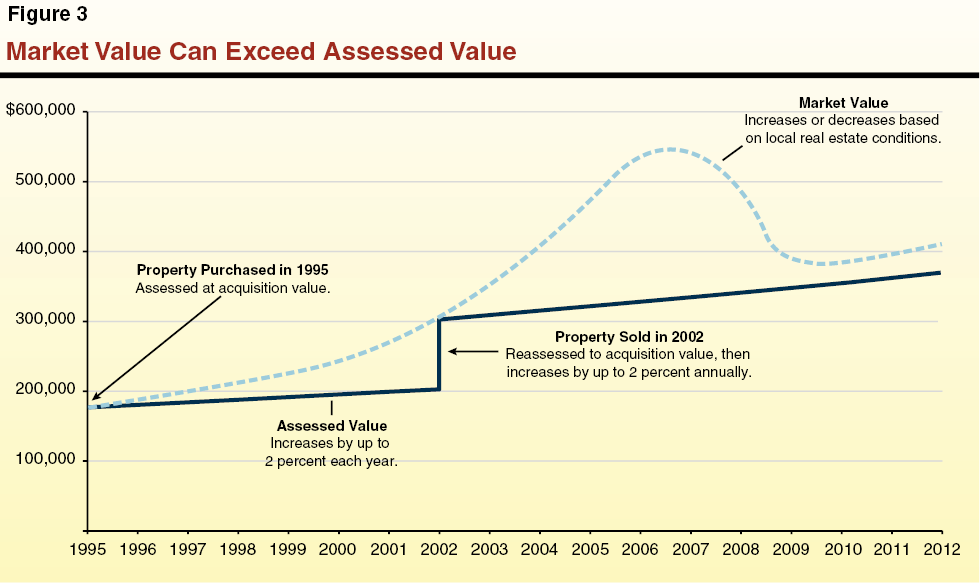

Understanding California’s Property Taxes

Property Tax Rate Los Angeles County Ca the median property tax (also known as real estate tax) in los angeles county is $2,989.00 per year, based on a median. the median property tax (also known as real estate tax) in los angeles county is $2,989.00 per year, based on a median. click below to download the tax rate area lookup file in.csv format (available for current year only). the median property tax in los angeles county, california is $2,989 per year for a home worth the median value of $508,800.

From exohtwovx.blob.core.windows.net

California Keep Property Tax at Ronald Nunez blog Property Tax Rate Los Angeles County Ca the median property tax (also known as real estate tax) in los angeles county is $2,989.00 per year, based on a median. the median property tax in los angeles county, california is $2,989 per year for a home worth the median value of $508,800. click below to download the tax rate area lookup file in.csv format (available. Property Tax Rate Los Angeles County Ca.

From ettaqsherilyn.pages.dev

Los Angeles County Property Tax Rate 2024 Sadie Martguerita Property Tax Rate Los Angeles County Ca click below to download the tax rate area lookup file in.csv format (available for current year only). the median property tax in los angeles county, california is $2,989 per year for a home worth the median value of $508,800. the median property tax (also known as real estate tax) in los angeles county is $2,989.00 per year,. Property Tax Rate Los Angeles County Ca.

From taxfoundation.org

Property Taxes by State & County Median Property Tax Bills Property Tax Rate Los Angeles County Ca the median property tax (also known as real estate tax) in los angeles county is $2,989.00 per year, based on a median. the median property tax in los angeles county, california is $2,989 per year for a home worth the median value of $508,800. click below to download the tax rate area lookup file in.csv format (available. Property Tax Rate Los Angeles County Ca.

From lao.ca.gov

Understanding California’s Property Taxes Property Tax Rate Los Angeles County Ca the median property tax in los angeles county, california is $2,989 per year for a home worth the median value of $508,800. the median property tax (also known as real estate tax) in los angeles county is $2,989.00 per year, based on a median. click below to download the tax rate area lookup file in.csv format (available. Property Tax Rate Los Angeles County Ca.

From www.propertytax.lacounty.gov

Adjusted Supplemental Property Tax Bill Los Angeles County Property Property Tax Rate Los Angeles County Ca click below to download the tax rate area lookup file in.csv format (available for current year only). the median property tax (also known as real estate tax) in los angeles county is $2,989.00 per year, based on a median. the median property tax in los angeles county, california is $2,989 per year for a home worth the. Property Tax Rate Los Angeles County Ca.

From www.propertytax.lacounty.gov

Supplemental Secured Property Tax Bill Los Angeles County Property Property Tax Rate Los Angeles County Ca click below to download the tax rate area lookup file in.csv format (available for current year only). the median property tax (also known as real estate tax) in los angeles county is $2,989.00 per year, based on a median. the median property tax in los angeles county, california is $2,989 per year for a home worth the. Property Tax Rate Los Angeles County Ca.

From www.propertytax.lacounty.gov

Annual Secured Property Tax Information Statement Los Angeles County Property Tax Rate Los Angeles County Ca the median property tax in los angeles county, california is $2,989 per year for a home worth the median value of $508,800. click below to download the tax rate area lookup file in.csv format (available for current year only). the median property tax (also known as real estate tax) in los angeles county is $2,989.00 per year,. Property Tax Rate Los Angeles County Ca.

From www.propertytax.lacounty.gov

Annual Secured Property Tax Bill Los Angeles County Property Tax Portal Property Tax Rate Los Angeles County Ca the median property tax in los angeles county, california is $2,989 per year for a home worth the median value of $508,800. click below to download the tax rate area lookup file in.csv format (available for current year only). the median property tax (also known as real estate tax) in los angeles county is $2,989.00 per year,. Property Tax Rate Los Angeles County Ca.

From stephenhaw.com

Rates of Property Taxes in California's The Stephen Haw Group Property Tax Rate Los Angeles County Ca click below to download the tax rate area lookup file in.csv format (available for current year only). the median property tax in los angeles county, california is $2,989 per year for a home worth the median value of $508,800. the median property tax (also known as real estate tax) in los angeles county is $2,989.00 per year,. Property Tax Rate Los Angeles County Ca.

From taxingtheproperty.blogspot.com

Property and Property Tax California Property Tax Change in ownership Property Tax Rate Los Angeles County Ca the median property tax (also known as real estate tax) in los angeles county is $2,989.00 per year, based on a median. click below to download the tax rate area lookup file in.csv format (available for current year only). the median property tax in los angeles county, california is $2,989 per year for a home worth the. Property Tax Rate Los Angeles County Ca.

From taxfoundation.org

How High Are Property Taxes in Your State? Tax Foundation Property Tax Rate Los Angeles County Ca the median property tax (also known as real estate tax) in los angeles county is $2,989.00 per year, based on a median. the median property tax in los angeles county, california is $2,989 per year for a home worth the median value of $508,800. click below to download the tax rate area lookup file in.csv format (available. Property Tax Rate Los Angeles County Ca.

From www.vrogue.co

Annual Secured Property Tax Bill Los Angeles County P vrogue.co Property Tax Rate Los Angeles County Ca the median property tax (also known as real estate tax) in los angeles county is $2,989.00 per year, based on a median. the median property tax in los angeles county, california is $2,989 per year for a home worth the median value of $508,800. click below to download the tax rate area lookup file in.csv format (available. Property Tax Rate Los Angeles County Ca.

From mommyalleahs.blogspot.com

how to lower property taxes in california Exuberant Vlog Ajax Property Tax Rate Los Angeles County Ca click below to download the tax rate area lookup file in.csv format (available for current year only). the median property tax (also known as real estate tax) in los angeles county is $2,989.00 per year, based on a median. the median property tax in los angeles county, california is $2,989 per year for a home worth the. Property Tax Rate Los Angeles County Ca.

From www.propertytax.lacounty.gov

Annual Secured Property Tax Bill Los Angeles County Property Tax Portal Property Tax Rate Los Angeles County Ca the median property tax in los angeles county, california is $2,989 per year for a home worth the median value of $508,800. the median property tax (also known as real estate tax) in los angeles county is $2,989.00 per year, based on a median. click below to download the tax rate area lookup file in.csv format (available. Property Tax Rate Los Angeles County Ca.

From ariellawshari.pages.dev

Tax Brackets 2024 California State Aleta Aurilia Property Tax Rate Los Angeles County Ca the median property tax in los angeles county, california is $2,989 per year for a home worth the median value of $508,800. the median property tax (also known as real estate tax) in los angeles county is $2,989.00 per year, based on a median. click below to download the tax rate area lookup file in.csv format (available. Property Tax Rate Los Angeles County Ca.

From taxwalls.blogspot.com

How Much Is Property Tax In Los Angeles 2013 Tax Walls Property Tax Rate Los Angeles County Ca the median property tax in los angeles county, california is $2,989 per year for a home worth the median value of $508,800. click below to download the tax rate area lookup file in.csv format (available for current year only). the median property tax (also known as real estate tax) in los angeles county is $2,989.00 per year,. Property Tax Rate Los Angeles County Ca.

From www.armstrongeconomics.com

US Property Tax Comparison by State Armstrong Economics Property Tax Rate Los Angeles County Ca the median property tax in los angeles county, california is $2,989 per year for a home worth the median value of $508,800. the median property tax (also known as real estate tax) in los angeles county is $2,989.00 per year, based on a median. click below to download the tax rate area lookup file in.csv format (available. Property Tax Rate Los Angeles County Ca.

From www.blog.rapidtax.com

California Tax Rates RapidTax Property Tax Rate Los Angeles County Ca the median property tax (also known as real estate tax) in los angeles county is $2,989.00 per year, based on a median. click below to download the tax rate area lookup file in.csv format (available for current year only). the median property tax in los angeles county, california is $2,989 per year for a home worth the. Property Tax Rate Los Angeles County Ca.